Charles Darwin is not the author of the proverb “the big fish eats the little fish”, but he should be, because few expressions better illustrate the thought of the famous “naturalist”; even above the “survival of the fittest”, the concept that reveals the wildest side of nature and also the very essence of the current economic order.

The brutal concentration of wealth and business in the last half century may be the central fact to understand these interesting times that we have to live. Except for the exit from extreme poverty of several hundred million people, especially in South Asia, this is the main manifestation of the new Gilded Age, a period of enormous economic growth, but also of corruption, greed, and exploitation.

Although we may be more interested in the cases of Facebook and Google, the best example to illustrate this phenomenon is that of Amazon. With a market value of 1.7 billion dollars, beyond being the undisputed leader in internet commerce in the world, the company seeks to become the market itself.

That, in addition to his aspiration, through Blue Origin, to control the nascent aerospace tourism industry.

In a global context of inequality, the United States stands out, a country in which in half a century the concentration of resources in the hands of the top one percent – the mega-rich – went from 8 percent to 38.6 percent of the national wealth, as explains Dr. Tim Wu in his book “The curse of bigness.”

Jeff Bezos is the most visible successor to the great “industrialists” who built much of the imperial America during the last three decades of the 19th century: Andrew Carnegie, John D. Rockefeller, Henry Ford, Cornelius Vanderbilt, and JP Morgan himself, the legendary “robber barons” (unscrupulous capitalists); in many ways, the fathers of the “savage capitalism” that we suffer today.

Bezos is the richest man in the world – his personal fortune is around 201 billion dollars – but even more important: he is the one who has best taken advantage of the legal reforms that in the last 50 have opened the doors to a business model – operate with losses until it took over the market – which served so much for the dizzying growth of the great technology giants.

“Amazon is the trade titan of the 21st century. In addition to retailing, it is an advertising platform, a distribution and logistics network, a payment service, a loan company, an auction house, a huge publishing house (it also owns the Washington Post), a huge television production company and cinema, fashion designer, tool maker and one of the main space managers in the digital cloud”, explained in 2016 the Yale University student, Lina M. Khan.

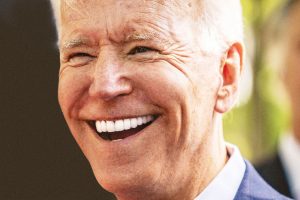

It was that same text – “Amazon’s Antitrust Paradox” – the key point that led President Joe Biden to appoint her, last June, director of the Federal Trade Commission (FTC), responsible for the impossible: moderate the oligopolistic and monopolistic condition that have infected the pharmaceutical, financial, oil, telecommunications, media, and air transportation industries.

Along with Professor Wu and a handful of other academics and activists, the 32-year-old Dr. Khan heads the compact group formed by the White House to try to stop the new giants of money and power in the field of law.

As it happened for decades with Walmart – which used a strategy of lowering costs and offering its products at low prices in thousands of small communities, until it came to control the retail market in various regions of the planet, now Amazon online sells more than Walmart in its 10,500 stores.

Beyond the undeniable personal talent of Bezos to take advantage of the irruption of new technologies, there is more to tell than the story of the small business that he founded in 1994 in the garage of his house to sell books among the cool communities of Seattle and San Francisco.

Simplifying to the extreme, the “secret recipe” would be something like getting speculative money – “markets” – to maintain a multimillion-dollar flow of money that for almost three decades allowed him to operate his business at a loss, until he managed to dominate the trade electronic. And as of 2016, now yes, obtain gigantic profits. In 2020 alone, Mr. Bezos celebrated his 58th birthday with the news that his business had a 38 percent revenue growth over the previous year. Thanks to the pandemic, of course.

The formula is not properly new. We are aware of the cases of large companies that, in the name of the efficiency of the economy of scale, “for the good of the people” and with all the support and complicity of politicians that money can buy – “we do not want a country of stalls”, Said Salinas – they reached a dominant and even monopolistic condition in their field. Then, as competition continued to fade as the sacred value of economic activity, some of those little giants began to be eaten up by transnational conglomerates. Sure, some of them turned into fervent “nationalists.” And so on, until reaching the current oligopolistic order of extreme inequality.